Understanding IPOs- Case Study on Reliance Power IPO

Investing in IPOs can be a smart move if you are an informed investor. But not every new IPO is a great opportunity. Benefits and risks go hand-in-hand. Before you join the bandwagon, it is important to understand the basics.

9th June 2024

Understanding IPOs: Concept, Process & Regulations

What is an IPO?

An Initial Public Offering (IPO) marks the first time a company sells its stock to the public. A privately held company, which typically has fewer shareholders and limited disclosure requirements, becomes a publicly traded one, bringing about significant transparency and accountability. This transformation is often referred to as "going public."

From an investor's point of view, IPOs offer the opportunity to buy into a company’s future and trade its stock on the open market. For companies, IPOs can raise large amounts of capital, enhance public image, and provide liquidity for existing shareholders.

Why Go Public?

Going public serves several strategic and financial purposes:

- Capital Infusion: Raises substantial funds for expansion or repayment of debt.

- Mergers & Acquisitions: Publicly traded stock can be used in M&A deals.

- Market Liquidity: Facilitates easier buying and selling of shares.

- Better Financing Terms: Public scrutiny often translates to improved debt terms.

- Attracting Talent: Enables stock options and employee stock ownership plans.

IPO Decision-Making: Pre & Post IPO Considerations

Pre-IPO Stage

The decision to go public must align with the company's overall strategic goals. It involves assessing market conditions, business maturity, and readiness for public scrutiny.

Post-IPO Stage

Post-listing, the company must maintain transparency, meet regulatory norms, and deliver consistent shareholder value.

IPO Process and Regulatory Framework in India

1. Procedural Steps

- Board & Shareholder Approval: Company’s board passes a resolution, followed by shareholders' approval.

- Appointment of Lead Manager (LM): A SEBI-registered merchant banker is appointed to guide the process.

- Drafting the Prospectus: Includes all disclosures per SEBI’s Disclosure and Investor Protection (DIP) guidelines.

- SEBI Review: Observations are received within 21 days.

- Filing with ROC: After SEBI clearance, the prospectus is filed with the Registrar of Companies.

- Listing Application: Applications are sent to stock exchanges.

- Marketing & Subscription: Issue is promoted and opened for subscription for 3–10 working days.

- Allotment & Refunds: Allotments are made, and excess application money is refunded.

- Listing on Stock Exchange: Post-approval, the stock starts trading.

2. SEBI Guidelines

- Free pricing was introduced in 1992.

- IPO must be in dematerialized form.

- Prospectus must be registered and signed by directors.

- Over-subscription up to 10% can be retained.

- Issue must be opened within 365 days of SEBI approval.

- Minimum subscription of 90% is mandatory.

3. Companies Act Provisions

- Prospectus requirements under Section 56.

- No allotment before the 5th day of issue.

- Refunds must be made within 8 days (with interest thereafter).

- Returns of allotment must be filed within 30 days (Form 2).

4. Listing Requirements (NSE)

- Minimum post-issue capital of ₹10 crore and net worth of ₹20 crore.

- For knowledge-based companies: capital of ₹5 crore and market cap of ₹50 crore.

- A minimum 3-year track record is needed.

Case Study: The Rise and Fall of Reliance Power IPO

About the Company

Reliance Power Limited was created to spearhead Anil Dhirubhai Ambani Group’s (ADAG) foray into the power sector. With plans to develop 13 power projects totaling 28,200 MW capacity, the company targeted India's projected power shortfall and government reforms in the energy sector.

The Mega IPO

- Opened: January 15, 2008

- Issue Size: ₹11,500 crore

- Price Band: ₹405–₹450 per share

- Public Issue: 22.8 crore shares

- Promoters' Contribution: 3.2 crore shares

- Oversubscribed: 73 times

- Listed: February 11, 2008

Managed by leading global and Indian investment banks, the IPO broke records in terms of demand and applications received (4.7 million).

Was the Pricing Justified?

Despite massive demand, the IPO faltered due to:

1. Premium Pricing with No Earnings

- IPO price of ₹450 was deemed unjustified.

- EPS at IPO time was only ₹0.01; thus, PE ratio was a staggering 45,000.

- Compared to NTPC and Tata Power, RPL was significantly overvalued.

2. Lack of Operational Assets

- No running plants; future projects under development.

- IPO proceeds were largely for land acquisition and infrastructure build-up.

3. Disparity in Promoter and Investor Pricing

- Promoters received shares at an average price of ₹16.92.

- Retail and institutional investors paid ₹450.

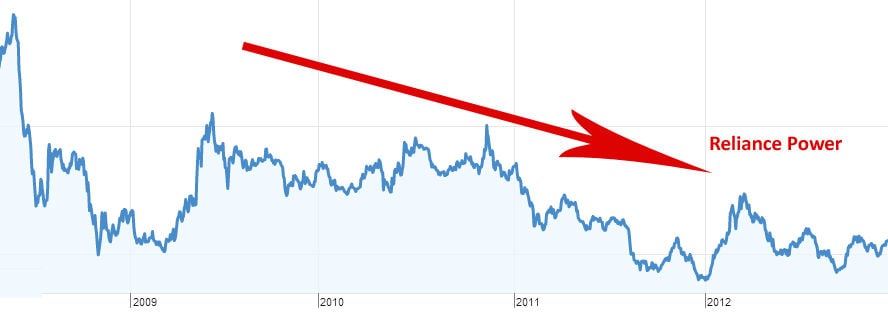

Listing Day Debacle and Fallout

- Opened strong but fell rapidly from ₹538 to ₹355 within minutes.

- Closed down 17% on Day 1.

- Market cap erosion of ₹4 billion on debut.

- Global financial turbulence worsened matters (Sensex fell 20% during the period).

Buyback and Retailer Relief

- ADAG offered ₹20/share discount and allowed part payment by retailers.

- Bonus issue of 3 shares for every 5 held announced later.

Why Did the IPO Fail?

A. Hype Over Fundamentals

- Retail frenzy driven by brand, not valuation.

- Over-reliance on slogans like “Power On, India On.”

B. High Net Worth Investor (HNI) Exit

- HNIs took loans to invest and exited quickly due to poor listing.

C. Peer Comparison

- NTPC was available at lower valuations with operational assets.

D. Economic Conditions

- Global downturn impacted investor sentiment.

- Sudden selloff by FIIs and banks on listing day raised questions.

Conclusion: Lessons Learned

The Reliance Power IPO underscores the risks of irrational exuberance. Key takeaways include:

- Objective Valuation: Use metrics like EPS, net worth, and peer comparison.

- Behavioral Caution: Don’t invest based on hype or branding alone.

- Investor Due Diligence: Evaluate use of funds, earnings visibility, and promoter credibility.

Despite its collapse, the IPO provides a valuable case for understanding market psychology and the importance of pricing discipline.

Comments

Sign in to leave a comment